June 29, 2021

With its 36 member-states and territories MONEYVAL is the largest of eight FATF-style regional bodies. It is the monitoring body of the Council of Europe entrusted with the task of assessing compliance with the principal international standards to counter money laundering and the financing of terrorism and the effectiveness of their implementation, as well as with the task of making recommendations to national authorities in respect of necessary improvements to their systems.

In its recently published 2020 Annual Report[1] MONEYVAL provides a comprehensive overview of key compliance trends in member-jurisdictions, describes the anti-money laundering challenges brought by the COVID-19 pandemic and presents the major activities and results achieved in 2020 in the area of mutual evaluations and their follow-up.

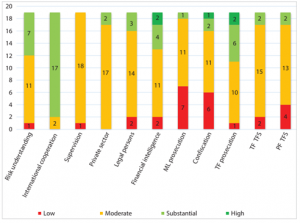

In 2020 MONEYVAL initiated a mid-term horizontal review of implementation of the FATF Recommendations of 19[2] member-jurisdictions. A graphic overview of effectiveness ratings[3] for these member-jurisdictions on key criteria is provided below.

The good, the bad and the ugly

While MONEYVAL member states and jurisdictions continue on average to demonstrate a moderate level of effectiveness in their AML/CFT efforts, MONEYVAL concludes that the median level of compliance is not at a satisfactory level. Some specifics that emerged from the reviews make for interesting reading. They demonstrate that too many members are as yet depressingly far from reaching a singular concerted approach to fighting financial crime. With conviction growing that public-private cooperation is key to successfully tackling financial crime it is imperative that countries step up their efforts and achieve a public sector level of competence and resources to be a consistently solid and reliable partner for their private sector counterparts.

The Good:

- Despite complications caused by the COVID-19 pandemic MONEYVAL members continued to be active in the development of their national AML/CFT frameworks. In addition to the regular process of mutual evaluations and follow-up, MONEYVAL collects general information on key AML/CFT institutional reforms carried out by its members. While the pace of reforms has predictably been slower than in prior years due to the pandemic, 28 of MONEYVAL’s 36 member jurisdictions noted legislative and institutional changes in the AML/CFT area in the course of 2020.

- Given the nature of money laundering and financing of terrorism, robust international cooperation is key to effective implementation of AML/CFT. The FATF Standards call for mutual legal assistance and other forms of international cooperation to the greatest extent possible and an established system for expeditious actions to be taken in response to requests made by foreign countries. To their credit, international cooperation and information exchange is the strongest point of MONEYVAL members.

The Bad:

- Efficient supervision of the private sector lies at the basis of an effective AML/CFT regime. Unfortunately, supervision is one of the areas where countries are less effective and no country was awarded a high effectiveness rating. The analysis underlines the significant differences in the global risk understanding among the supervisors, especially the supervisors of the designated non-financial sectors. Insufficient resources were identified with 63% of the supervisors in the assessed jurisdictions.

- Lack of adequate human resources and expertise of competent authorities was cited as a cross-cutting issue in the majority of assessed countries. As regards supervisors, the analysis highlights insufficient resources and/or expertise in 12 (63%) of the assessed jurisdictions.

- A condition for law enforcement authorities to successfully conduct their financial investigations is their ability to easily obtain beneficial ownership information in a timely manner. The analysis shows that countries generally apply insufficient measures to ensure that this information is accurate and up to date. Maintaining beneficial ownership registers is one of the tools frequently used in the European space, and eight countries assessed thus far have operational beneficial owners registers. At the same time only three of them (16%) have efficient mechanisms to verify the information contained in these registers.

The Ugly:

- Risk understanding is the central pillar of a robust AML/CFT system. An inadequate understanding of country risks leads to inappropriate policies. In more than 80% of the assessed countries in 2020, the MONEYVAL analysis highlights the absence of in-depth assessment of certain risks, such as terrorism financing and offshore money laundering. If the assessment of risks is not thorough, risk-based responses by definition cannot be effective.

In conclusion, the 2020 Annual Report highlights that MONEYVAL members demonstrate the best results in the areas of international cooperation and use of financial intelligence. Effectiveness remains particularly weak in financial sector supervision, private sector compliance, transparency of legal persons, money laundering convictions and confiscations, financial sanctions for terrorism and proliferation of weapons of mass destruction. Unfortunately, plenty of loopholes remain for criminal organisations to exploit.

Pieter van den Akker – June 2021

[1] https://rm.coe.int/0900001680a2b3a4

[2] Armenia, Serbia, Hungary, Slovenia, Isle of Man, Andorra, Ukraine, Albania, Latvia, Czech Republic, Lithuania, Israel, Moldova, Malta, Russian Federation, Gibraltar, Cyprus, Slovak Republic and Georgia

[3] MONEYVAL Annual report for 2020